I’m embarrassed to say that I only recently learned what the Dow Jones Industrial Average actually is. A few weeks ago, on a podcast (Jim Collins on ChooseFI, eagerly anticipating the next conversation in that series, by the way!) it was finally explained in simple, plain language. And, like so many other Sphinx-like mysteries, once it was demystified, I couldn’t believe I’d once found it so utterly unknowable.

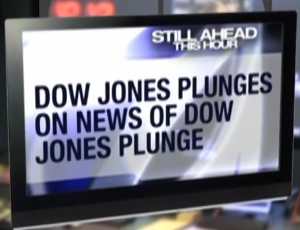

On a recent long-haul flight, availing myself of the expanse of hours and selection of films (cheers, Virgin Atlantic), and on the recommendation of my boyfriend, I started watching the movie Arrival. It wouldn’t have been something that would’ve jumped out at me, but his recommendations are generally sound, so I gave it a go. Early on in the film, in a completely throwaway line, a TV news announcer mentions something like: “the Dow Jones Industrial Average fell 2000 points.” Nothing noteworthy, but I heard it in a new light after listening to that podcast. We all know what the screenwriter wanted to convey was: the stock market is taking a nosedive! And the generally accepted standard fill-in-the-blank words to use are “something something the Dow!!!”

I started thinking about the whole chain of people who, in all likelihood, hadn’t the slightest clue what “the Dow” is, much less why anyone should care. The screenwriter, the actor delivering the line, the majority of the audience. And I remembered hearing that term as a kid, and getting this weird sense that it was something, along with a lot of other financial stuff, that the grownups didn’t know about any more than I did. Like everyone was kind of fudging their way along. Kids can smell bullshit a mile away, and that was definitely some bullshit.

But somewhere along the way, we stop feeling comfortable asking questions, I guess. Which is a pretty lame excuse for how I went 32 years, including nearly 10 years in a finance-adjacent profession, without ever really knowing what the Dow was, exactly. I know from experience that even other smart people have similar shrouds of mystery over things like how various tax advantaged retirement schemes work, what even are dividends, and what to do with their W-4’s (US-specific, so don’t panic, non-US friends). And the reason that some of these topics seem so mysterious is that even the people who are supposed to understand them, don’t. Not really, anyways. Not such that they could explain it to aliens (sorry, I’ve just seen Arrival).

This is just one more small way that people are disenfranchised when it comes to their money. We’re made to feel as if we’re the only ones thick enough not to know what the newscaster is on about when he’s talking about “the Dow” like it was his best friend. If you asked him what it was, he mightn’t be able to tell you. But he probably feels too intimidated to ask, too.

It’s incredibly off-putting, and it’s why a lot of people just steer clear of the whole area. For me, I’ve only ever been content with my level of understanding of something if I feel comfortable explaining it to someone else. Years of providing US tax consultations to a population of highly analytical newcomers to the US will entrench that belief. You’d want to be really clear on your pre-tax vs. your after-tax vs. your Roth 401k’s, for example. Because the guys I was giving these consultations to would grill you on it, and have you explain it 5 different ways, with examples. They were taking full advantage of a little-known, and rarely exploited privilege afforded to anyone who’s new to a topic and not afraid to ask questions until they’re satisfied they get it. I learned to respect and emulate this approach as yet more #immigranthustle magic.

And that’s how we should all approach this stuff. Ask loads of questions, and don’t rely on advice from anyone who can’t explain something in clear, simple language. And never feel stupid for asking. Smart people ask.